Nur Finance Software Algorithmic Trading Engine (NFS 1.0)

NFS uses several complex mathematical analysis and statistical models to calculate all possible American stocks and detect the best trading opportunities. The software eliminates all human interactions and emotions from the trading process. NFS creates portfolios that contain S&P 500 companies to minimize Stock market risk.

Portfolio Creation Process

NFS has a vast historical database for S&P 500 companies, S&P 500 companies’ supplier companies, and S&P 500 companies’ customer companies. The database holds historical price, market cap, income, dividend, P/E ratio, and hundreds more, all available data. Besides that, it contains all available reports related to stock markets, including construction reports, manufacturing reports, nonmanufacturing reports, unemployment, consumer confidence, and many more.

Mathematical Methodology

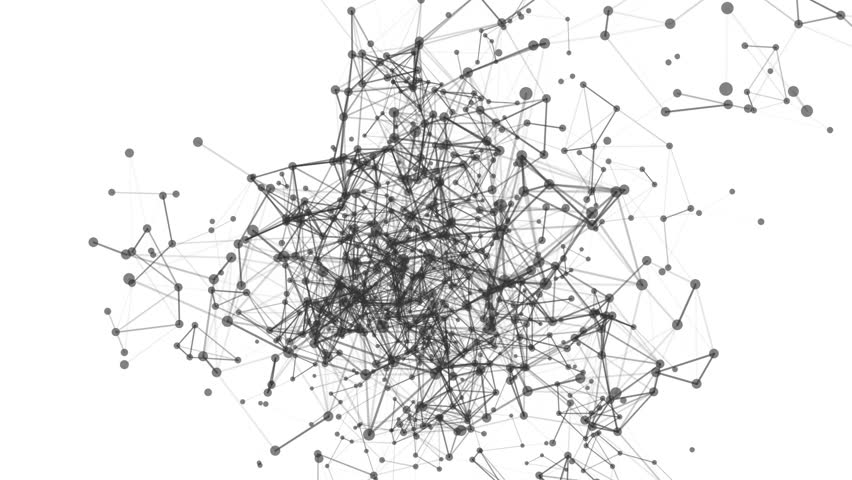

NFS approaches S&P 500 companies, their supplier, and their customers as a complete network. It approaches individual companies as quantum objects and sectors as quantum systems. It uses Quantum Statistical Mechanical Approach to define interactions among individual sectors, companies, and the entire system, as a whole. Each quantum objects create a node in the multigraph whereas the supplier-customer relations between companies present edges. Nodes are clustered under quantum systems to generate the final multigraph.

Our AI techniques uses several metrics to calculate the weight between each quantum edges. At any given time, NFS uses the mentioned data, reports, and computational techniques above to form a Probability Density function (PDF) based on two steps. In the first step, it forms Template Probability Density Functions (TPDF), and in the second step, it forms Superpositioned Probability Density Function (SPDF). NFS uses historical SPDFs as a train dataset for the AI. In addition to SPDFs, the multigraph sets a super-seed to the AI engine to detect network motifs. Automatic learning enables the NFS AI to improve prediction capability without human support and guidance by employing algorithms based on comparison logic. Therefore, each year the algorithm learns more and more from the current market conditions by checking previous values.

The first step is picking the best performing sectors and picking the best-performing stocks within these sectors. At this point, NFS forms the TPDF.

In the second step, NFS substitutes and subtracts individual stocks that form TPDF with the rest of the S&P 500 companies and form tens of thousands TPDF and compare volatilities and potential returns.

NFS AI evaluates each TPDF and generates the Likelihood function based on its training dataset. When these comparison periods finish, NFS forms the optimized SPDF to generate the final portfolio with minimum volatility, maximum diversification, and maximum return expectation.