NFS – BHFI Comparison

Barclay Hedge is an institution making research on 5831 different Hedge Funds worldwide and regularly presents their returns. The Barclay Hedge Fund Index (BHFI) is a measure of all hedge funds’ average performance in the Barclay database.

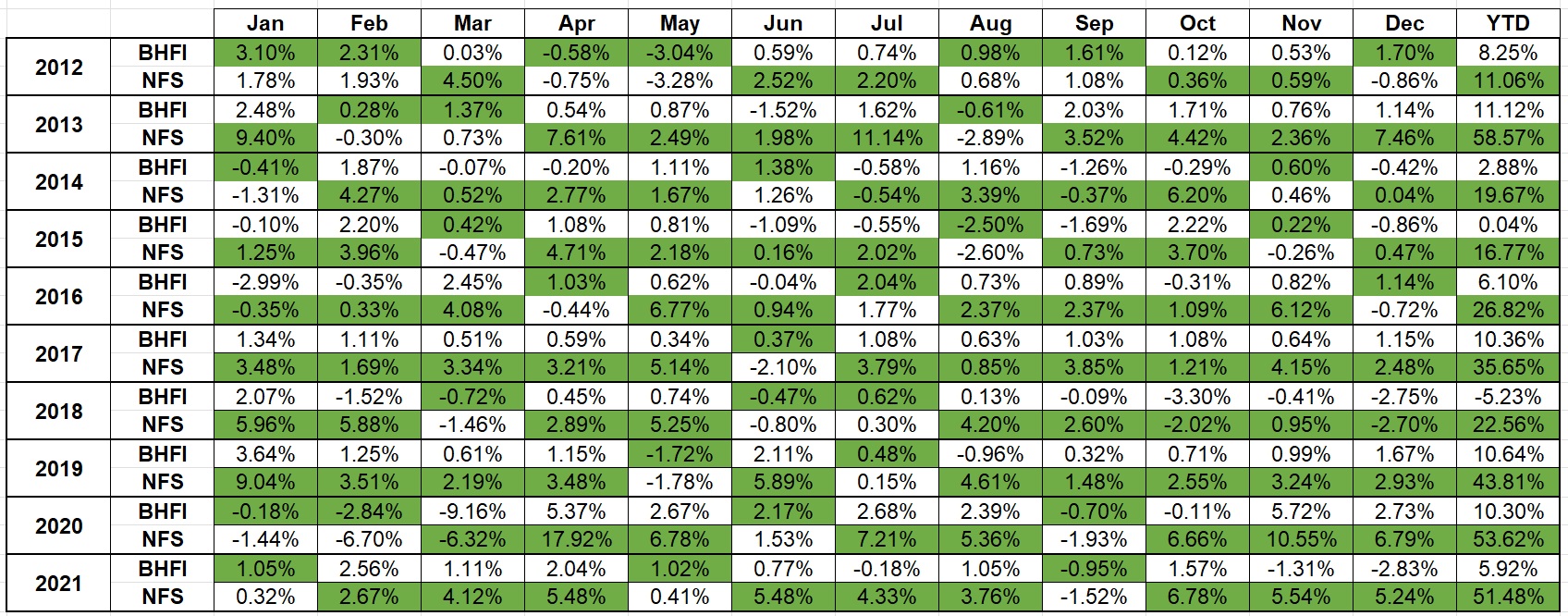

Figure presents a monthly comparison between NFS and Barclay Hedge Fund Index. The green color highlights which one returned better that month. It is clear that NFS outperformed the Hedge fund industry in terms of performance. NFS outperformed each year with a minimum of 3% more in 2012 and a maximum of 47% more in 2013. NFS’s average outperform percentage is 27.96% more than the BHFI in the last 10 years. Another crucial factor occurs in 2018. The average hedge fund return is -5.23% loss, whereas NFS successfully return 22.56% profit.

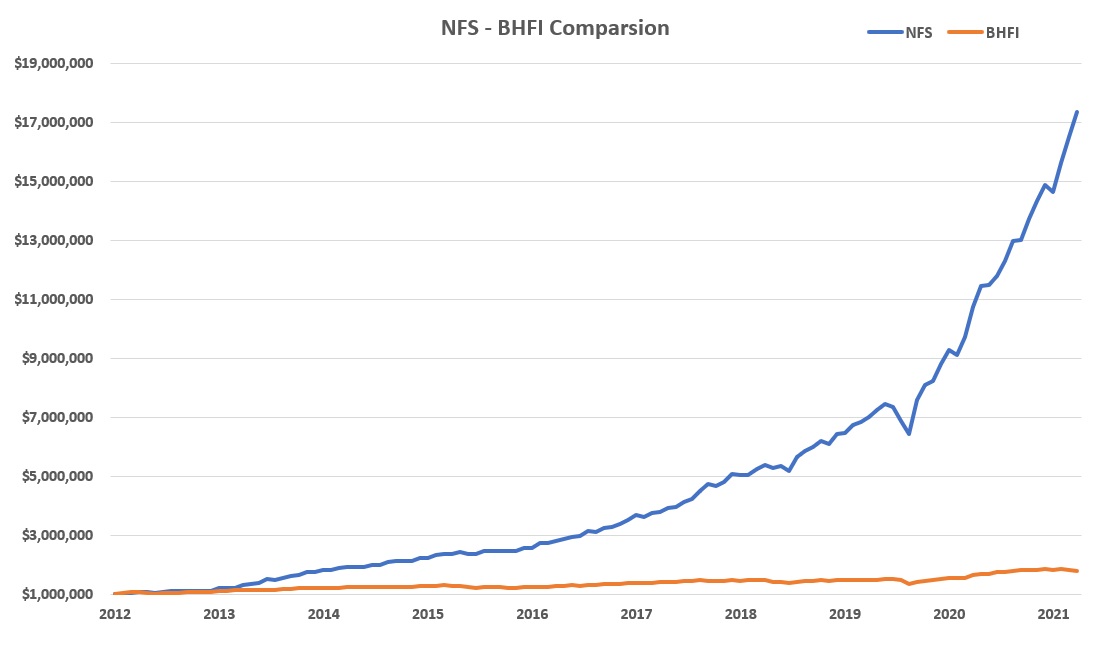

Figure presents the comparison between NFS and BHFI. If an investor gave his $1,000,000 to a hedge fund in January 2012, he would receive $1,774,736 on the average at the end of December 2021. However, NFS returns $17,363,757 at the same time range which is 21.12 times more in terms of profit.